Investment Options

As a full-service brokerage firm, we access a wide range of investment vehicles on a global basis. Below is a range of investment vehicles we offer.

- Individual Securities – Common Stock & Preferred shares, REITs, Bonds

- ETFs (Exchange Traded Funds)

- Private Debt

- Private Equity

- Private Real Estate

- Mutual Funds, Closed & Open

- Creditor Protected Investments

- GICs (Guaranteed Investment Certificate)

- High-Interest Savings Accounts

We reiterate the saying COMPLEXITY SIMPLIFIED in order to remind ourselves and our clients what the goal at hand really is. We are here to help navigate the complexities of wealth management and instill true confidence into those we serve.

Investment Philosophy

Harbourfront Belief

With the current interest rate environment, investors can no longer turn to cash or near cash investments as a means to build and retain wealth. Over time income tax implications and inflation erode capital. The opposite extreme of aggressive equities is also an approach which we don’t favor.

Clients will typically experience 5-7 economic market cycles before transferring their wealth. Trying to time these cycles is a futile exercise and so we prefer to prepare rather than react.

Our belief as such is that more can be achieved through efficient portfolio construction. By quantifying risk through back-tested portfolio analyses while comparing with past and projected returns, we have been successful in capturing strong returns during periods of market growth and preserving more capital during economic contractions.

Security Selection

As investors, we must remember that a stock or bond is issued by an underlying business. When selecting securities we ask ourselves a number of questions. Do we feel that this company will be in business and have paying customers regardless of various economic environments? Do we feel that this company has a competitive advantage within its industry & do we feel it is likely to grow its business? Does the company have a strong management team and has it been consistent in growing its earnings? Despite different economic periods, conflicting political views & civil unrest, human beings will always need certain goods and services. By investing in the companies that provide the products and services we just can’t do without, we will benefit from these businesses’ long term productivity.

How We Feel About Income

In addition to seeking capital appreciation, we see income as another form of profit. Whether our clients need a regular stream of income or prefer not to draw from their portfolio, tax efficient income based investing forms part of our portfolio construction efforts.

We believe that income based investing also contributes to our clients’ risk management plan. A regular stream of income reduces overall volatility while also returning the initial capital investment over time.

Accessible Multi-Manager Private Securities

Private Asset Classes

Unified Managed Accounts

Why Watermark Private Portfolios?

The Watermark Private Portfolio Program is a Unified Managed Account using a multi-strategy, total portfolio solution consisting of stocks, bonds, ETFs, and managed investments all in one account. The benefits of utilizing the Watermark Private Portfolios are extensive. Certain offerings are for qualified investors only.

Why Watermark Private Portfolios?

Ability to hold securities from multiple managers all in one account.

Access to Alternative Investments

Access to private lending pools, private real estate pools, and other alternative investments typically available to institutions, like pension plans or endowment funds.

Householding

Simplify your portfolio reporting by including all family accounts as well as corporations, trusts, etc. into one quarterly report.

Asset Allocation

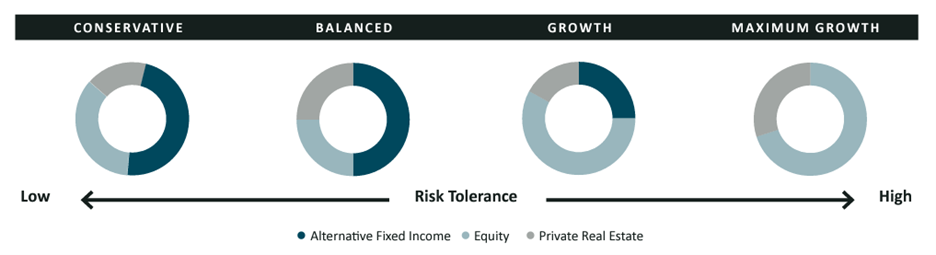

The Watermark Private Portfolio Program is designed for long-term investors who wish to build wealth by following an investment plan that may include an allocation to alternative assets.

When it comes to investing, the biggest challenge for investment advisors and their clients is finding a core investment solution that provides the opportunity for strong and predictable returns while managing the variability associated with the ups and downs of stock markets. And while investors understand the advantages of long-term investing, in practice, most investors have a tough time accepting and dealing with the volatility associated with investing in specific asset classes.

Tactical Asset Allocation takes a more dynamic approach and seeks to systematically identify and respond to market trends. This offers the flexibility to invest in a wide range of asset classes and the opportunity to provide meaningful diversification and better risk management measures designed to provide smoother, more predictable returns and a better overall investment experience.

Active portfolio managers move money between different asset classes (cash, fixed income, and equity) to improve risk-adjusted returns:

- Weaker equity markets – Look to overweight fixed income/cash

- Stronger equity markets – Look to overweight equities

Core Positions

Core holdings in one or more portfolio pools will make up the bulk of the assets. Other investments may complement core holdings and may allow for tactical investment decisions for movement between asset classes and to provide diversification between asset classes, sectors, and geographical regions.

- Private Credit: Accessible though our affiliated investment fund manager, Willoughby Asset Management, the Rockridge Private Debt Pool provides consistent cash flows and enhanced returns.

- Private Real Estate: Accessible though our affiliated investment fund manager, Willoughby Asset Management, the Forsyth Private Real Estate Pool provides consistent cash flows, generally higher than those available through traditional bonds and/or bond proxies.

- Private Equity: Multiple core equity and/or balanced pools can be held in the Watermark Private Portfolio Program depending on the portfolio model selected. These pools are designed to give investors the ability to participate in upside during periods of equity market expansion and more importantly, protect capital when markets are not performing well. Most pools also have the ability to move in part or entirely to cash, and/or fixed income and/or commodities, etc. to protect capital.

Contact Us

If you have any questions or inquiries for us or would like to set up a meeting, please do not hesitate to reach out. We would love to answer any questions you may have in order to help you better understand the process.