Pension Style Saving

While pension & endowment funds recognize the importance of diversification by including private debt and real estate in their portfolios, retail investors have a difficult time accessing alternatives to stocks and bonds. Private debt and real estate may provide portfolio stability and offset the volatility in equity and fixed income markets.

Faced with increasing interest rates, investors are struggling to find yield without increasing risk as traditional bonds no longer work. Pension and endowment funds have been shifting from publicly traded fixed-income investments to alternatives like private debt, private real estate, and private equity to enhance returns.

Multilayered Approach

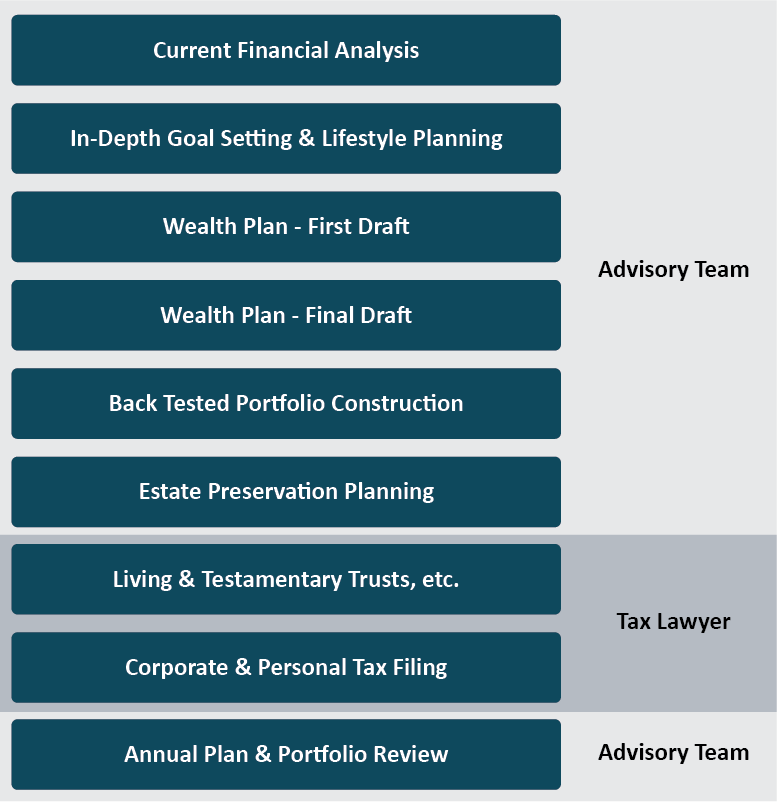

Managing your net worth involves much more than your investment accounts. The integrated, multilayered approach encompasses tax minimization planning, portfolio construction, and management, retirement income planning, trusts & estate preservation as well as risk management.

Once the plan has been implemented, a structured review program is put in place that includes regular comprehensive wealth management assessments as well as portfolio reviews.

Our advisory team can also work with your accountant and/or tax lawyer directly as needed.

Who’s Managing My Money?

Looking beyond the services and products commonly available to retail investors allows Harbourfront to stay client-centric, and focused on the best avenues for preservation and enhancement of wealth. The Integrated Net Worth Model provides advanced services beyond those generally available through accountants and investment advisors. We integrate your wealth plan with the advice of your accountant lawyer or other legal professional to provide a holistic strategy for you to achieve your wealth goals.

- Income planning & projecting

- Retirement planning

- Traditional Investments

- Alternative investments

- Private investments

- Back tested portfolio construction

- Tax Planning

- Trusts & estate preservation planning

- Philanthropic planning

- Intergenerational Transfers of Wealth and Legacy Planning

- Insurance products *

*Insurance products are sold via Harbourfront Estate Planning Services Inc,. (HEPSI). These products are not subject to CIRO regulation or CIPF coverage, please inquire with your advisor for more information.

Contact Us

If you have any questions or inquiries for us or would like to set up a meeting, please do not hesitate to reach out. We would love to answer any questions you may have in order to help you better understand the process.